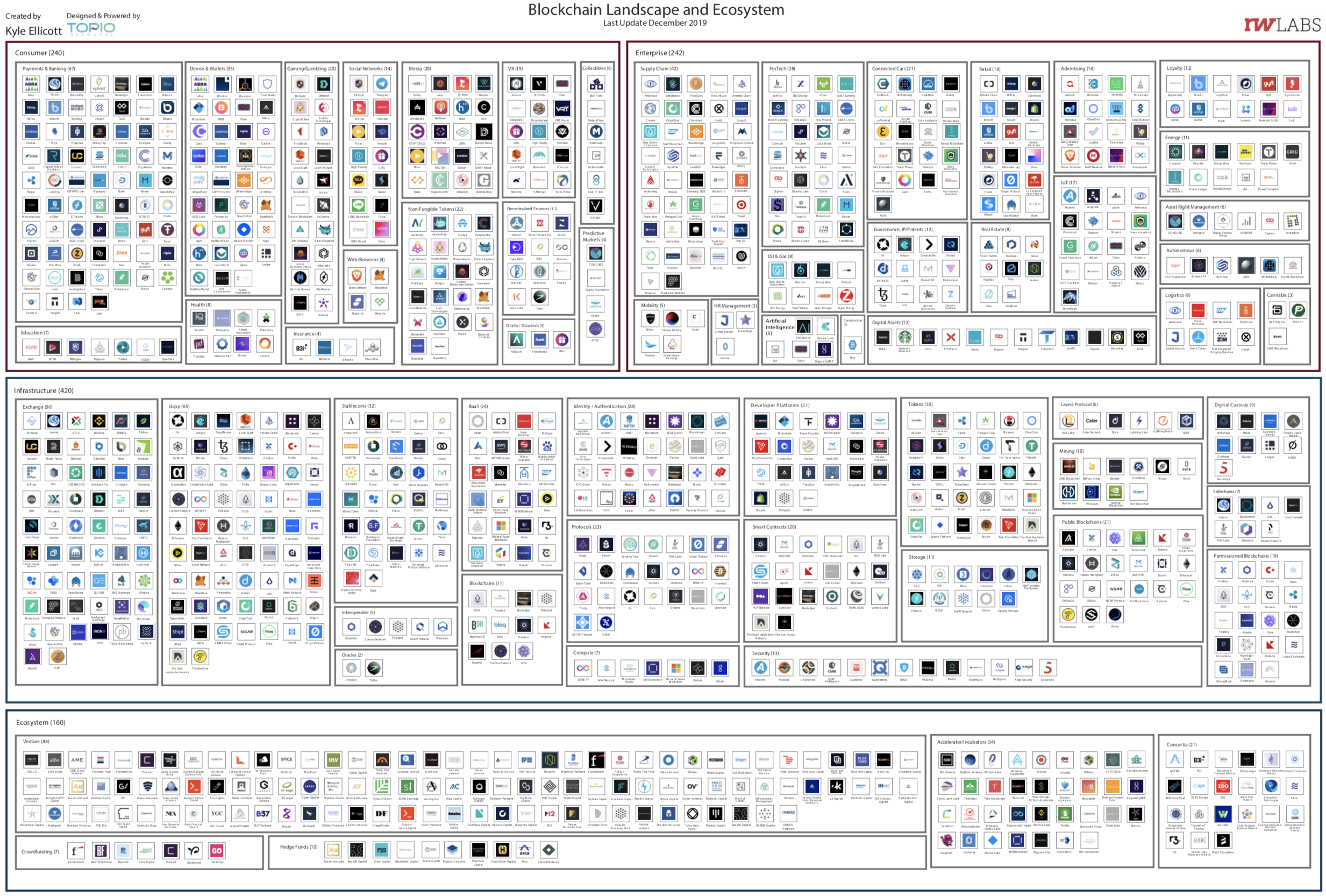

DeFi (Decentralised Finance) is growing fast. So fast that it’s difficult to keep on top of all the new projects and DApps that are being announced. Nevertheless, it’s something I’ve been trying to do since the summer of 2020, and over the months I’ve accumulated a decent list through my own research. It occurred to me that this research might be useful to others in the community, and so to celebrate the milestone of 500 projects added, I’m today publishing my research as a public resource.

I call it the DeFi Database, and it’s live today at https://defidatabase.info .

How to use DeFi Database

The DeFi Database is hosted at this link, where you can see the data as a read-only embedded table.

A screenshot of the DeFi Database site. Sorting, Grouping, and Filtering is supported.

By default, the projects are sorted by Name A-Z. You can however sort by whatever you wish. Single or multi-level sort supported.

Columns currently included are Name, Category (multiple supported), Short text description, Ecosystem (i.e. blockchain network), Link (URL) and ‘Primitive/Token’ (‘True’ if there is a token associated with the project, otherwise ‘False’). Additional columns may be added in future (see FAQ below).

The ‘category’ is probably the most useful for discovery of new projects. For example, you could Filter on category to see a list of projects with the tag ‘Stablecoins’:

Applying a filter on category contains ‘stablecoins’.

At time of writing, the following category taxonomy was in use:

28 DeFi categories (so far).

You can also Group data. For instance you may wish to Group on the ‘Ecosystem’ column to differentiate ‘Bitcoin-only’ DeFi projects with those that are multi-chain.

Grouping data on ‘Ecosystem’.

Finally, find what you are looking for quickly by using the search tool (top right) or simply pressing Ctrl / Command + F.

The database has been built using https://airtable.com/. If there are any other questions on functionality it is suggested to read the air table documentation.

That’s about it! Thanks for your support, and if you want to be informed about new developments with this database or other stuff I’m working on, please feel free to subscribe using the form here.

Frequently Asked Questions (FAQ)

Is this a commercial project?

No. This is a hobby project that has been opened up for the benefit of the wider community. No money has changed hands in the creation and distribution of this database. All data is publicly available, and there are no sponsored record insertions or promotions.

Who maintains DFDB?

At time of writing, the DeFi Database is maintained by me, Andy Bryant, a professional in the crypto space and DeFi enthusiast. I intend to keep DeFi Database updated myself in the near term, at least until this task becomes too heavy on my time. If you’d like to volunteer to help out, please do get in touch!

Why is X project not in the database?

If there is a DeFi project that you cannot find in this database, then it’s usually because (a) I’m not aware of the project yet, or (b) it’s not eligible for inclusion in the database. To find out more about what makes a project eligible for inclusion, see below.

What sort of projects are eligible to be featured on DeFi Database?

Any serious project that can reasonably considered as related to ‘DeFi’ (i.e. financial applications that do not rely on central financial intermediaries) is eligible for inclusion.

The following will not be added:

Copycat or ‘me-too’ forks of projects that doesn’t bring any meaningful new innovation (e.g. ‘food-coin’ yield farms, meme-based projects, etc.)*

Tokens or blockchains that are just new assets, without a meaningful connection to DeFi (i.e. this is not a list of tokens like CoinGecko / Coin Market Cap).

Test net projects that aren’t interacting with main net contracts or processing ‘real’ crypto assets.

Projects that aren’t directly or indirectly linked to financial applications or primitives (e.g. logistics, gaming).

* There may be exceptions made in particular situations (e.g. Sushiswap was added as a clone of Uniswap because of its innovations around governance).

If you would like to submit a new project for inclusion in the database, please be my guest; you can use this form here. They will be added after review.

Is this just for Ethereum DeFi projects?

No. Although Ethereum is where most of DeFi is currently transacting, DeFi projects on any blockchain network can be eligible. At time of writing, featured blockchain networks include ETH, BTC, SOL, XTZ, BNB, DOT, EOS, ADA, and TRX although the vast majority of projects are on ETH. I can’t guarantee great coverage for less active networks.

I’ve spotted a mistake, how do I let you know?

For errata, please get in touch using this form or the ‘Errata’ link on the site. Thanks for your support in keeping this a useful resource.

Why is there missing information on some records?

I don’t always have the time to complete all records in full, usually because I was just making a brief note after seeing the project name featured somewhere else. I do intend to go back and fill in the gaps, but it might not happen straight away.

What’s coming up for DFDB?

I will endeavour to stay on top of latest developments in the DeFi space, and in future expect to be making more additions for non-Ethereum blockchain projects as these other DeFi ecosystems begin to emerge. I may also add new columns (e.g. Twitter handles) but since that will take a lot of back filling it could take some time.

If you’d like to know anything else, please get in touch! And thanks for your support.